Principles of Finance ACST603

Tutorial 9, Week 9 Capital asset pricing model

Homework questions.

Treasury bonds currently have a return of 5% pa. A stock has a beta of 0.5 and the market return is 10% pa. What is the expected return of the stock?

Let the stock be represented by 'i'. To make the notation elegant, let the stock's expected return (##E(r_i)##) be represented by ##\mu_i##.

Using the CAPM's SML equation,

###\begin{aligned} \mu_i &= r_f + \beta_i(\mu_m-r_f) \\ &= 0.05 + 0.5(0.1-0.05) \\ &= 0.075 \end{aligned} ###

A stock has a beta of 0.5. Its next dividend is expected to be $3, paid one year from now. Dividends are expected to be paid annually and grow by 2% pa forever. Treasury bonds yield 5% pa and the market portfolio's expected return is 10% pa. All returns are effective annual rates.

What is the price of the stock now?

Starting with the CAPM's SML equation we can find the required return from the stock's beta, the market return and the risk free rate:

###\begin{aligned} \mu_E &= r_f + \beta_E(\mu_m-r_f) \\ &= 0.05 + 0.5(0.1-0.05) \\ &= 0.075 \\ \end{aligned} ###

Now that we have the required return on equity we can discount the dividends on equity using the perpetuity with growth formula, also known as the Gordon growth model.

###\begin{aligned} P_0 =& \frac{C_1}{\mu_{E} - g} \\ =& \frac{3}{0.075-0.02} \\ =& 54.5454545 \end{aligned}###According to the theory of the Capital Asset Pricing Model (CAPM), total variance can be broken into two components, systematic variance and idiosyncratic variance. Which of the following events would be considered the most diversifiable according to the theory of the CAPM?

Diversifiable events affect only a specific company or industry or area, such as a firm's poor earnings announcement. Systematic events affect a whole country or the world and can't be avoided.

A stock's required total return will increase when its:

Total required returns only depend on systematic risk since that's the only risk that can't be diversified. Investors are afraid of systematic risk and deserve a higher expected return when exposed to this undiversifiable risk. This relationship is expressed mathematically in the security market line (SML) equation from the capital asset pricing model (CAPM). The total required return ##(r_\text{i, total})## of some asset ##i## is a function of its beta ##(\beta_i)##, which measures systematic risk.

###r_\text{i, total} = r_f + \beta_i(r_m - r_f)###A stock has a beta of 1.5. The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

What do you think will be the stock's expected return over the next year, given as an effective annual rate?

A stock has a beta of 1.5. The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

In the last 5 minutes, bad economic news was released showing a higher chance of recession. Over this time the share market fell by 1%. The risk free rate was unchanged.

What do you think was the stock's historical return over the last 5 minutes, given as an effective 5 minute rate?

Over the last 5 minutes, the return on the risk free rate would be close to zero ##(r_{f\text{ 5 min}} \approx 0)## since it's only 5% per year. The historical market return ##(r_{m\text{ 5 min}})## over the last 5 minutes was -1%. Note that in the CAPM equation below all returns are effective 5 minute historical returns. Substituting this into the CAPM equation: ###\begin{aligned} r_{i\text{ 5 min}} &= r_{f\text{ 5 min}} + \beta_i(r_{m\text{ 5 min}}-r_{f\text{ 5 min}}) \\ &= 0 + 1.5 \times (-0.01-0) \\ &= -0.015 \\ \end{aligned} ###

Discussion of why the 5 minute risk free rate is close to zero

To find the exact 5 minute risk free rate and show that it is truly close to zero, let's convert this 5% effective annual risk free rate into an effective 5 minute risk free rate. Assume that there are 365 days per year, 24 hours per day, 60 minutes per hour and therefore 12 (=60/5) five minute periods per hour.

###(1+r_{f\text{ 5 min}})^\text{number of 5 min periods in a year} = (1+r_{f\text{ annual}})^1### ###(1+r_{f\text{ 5 min}})^{365 \times 24 \times 60 / 5} = (1+r_{f\text{ annual}})### ###\begin{aligned} r_{f\text{ 5 min}} &= (1+r_{f\text{ annual}})^{1/(365 \times 24 \times 60 / 5)}-1 \\ &= (1+0.05)^{1/(365 \times 24 \times 60 / 5)}-1 \\ &= 0.000000464137895 \text{ pa} \\ &= 0.0000464137895 \text{% pa} \\ &\approx 0\text{% pa} \end{aligned}###A stock has a beta of 1.5. The market's expected total return is 10% pa and the risk free rate is 5% pa, both given as effective annual rates.

Over the last year, bad economic news was released showing a higher chance of recession. Over this time the share market fell by 1%. So ##r_{m} = (P_{0} - P_{-1})/P_{-1} = -0.01##, where the current time is zero and one year ago is time -1. The risk free rate was unchanged.

What do you think was the stock's historical return over the last year, given as an effective annual rate?

Over the last year, the historical effective return on the risk free rate was 5% ##(r_f = 0.05)##. The historical market return ##(r_m)## over the last year was -1% ##(r_m = -0.01)##. Note that in the CAPM equation below all returns are effective annual historical returns. Substituting this into the CAPM equation: ###\begin{aligned} r_i &= r_f + \beta_i(r_m-r_f) \\ &= 0.05 + 1.5 \times (-0.01-0.05) \\ &= -0.04 \\ \end{aligned} ###

Question 807 market efficiency, expected and historical returns, CAPM, beta, systematic risk, no explanation

You work in Asia and just woke up. It looked like a nice day but then you read the news and found out that last night the American share market fell by 10% while you were asleep due to surprisingly poor macro-economic world news. You own a portfolio of liquid stocks listed in Asia with a beta of 1.6. When the Asian equity markets open, what do you expect to happen to your share portfolio? Assume that the capital asset pricing model (CAPM) is correct and that the market portfolio contains all shares in the world, of which American shares are a big part. Your portfolio beta is measured against this world market portfolio.

When the Asian equity market opens for trade, you would expect your portfolio value to:

No explanation provided.

Diversification is achieved by investing in a large amount of stocks. What type of risk is reduced by diversification?

Other names for diversifiable risk include:

- idiosyncratic risk

- firm-specific risk

- unique risk

- residual risk

- non-market risk

- non-systematic risk

Other names for systematic risk include:

- market risk

- undiversifiable risk

- beta risk

According to the CAPM, total risk is comprised of systematic and diversifiable risk. Mathematically, for some asset 'i':

###\text{total variance} = \text{systematic variance} + \text{idiosyncratic variance}### ###\begin{aligned} \sigma_\text{total, i}^2 &= \sigma_\text{systematic, i}^2 + \sigma_{\text{idiosyncratic, i}}^2 \\ &= \beta_i^2\sigma_\text{m}^2 + \sigma_{\epsilon\text{, i}}^2 \\ \end{aligned}\\###Idiosyncratic risk can be reduced by diversification but systematic risk can not.

Question 657 systematic and idiosyncratic risk, CAPM, no explanation

A stock's required total return will decrease when its:

No explanation provided.

A fairly priced stock has an expected return equal to the market's. Treasury bonds yield 5% pa and the market portfolio's expected return is 10% pa. What is the stock's beta?

Since the stock is fairly priced, it must plot on the security market line (SML). It also has the same required return as the market portfolio. Therefore the stock must must have the same beta as the market, which is one.

A more mathematical answer can be shown using the CAPM's SML equation. Let the stock be 'i'.

###\mu_i = r_f + \beta_i(\mu_m - r_f)### ###0.1 = 0.05 + \beta_i(0.1 - 0.05)### ### \beta_i = 1###In case you're interested in why the market's beta is one, read on. The market's beta must be one because the covariance of the market portfolio's returns with itself is its variance of returns, and this divided by the same variance equals one.

Using the Greek symbols typically used in statistics:

###\begin{aligned} \beta_i &= \dfrac{\sigma_{i,M}}{\sigma_i.\sigma_M} \\ \beta_M &= \dfrac{\sigma_{M,M}}{\sigma_M.\sigma_M} \\ &= \dfrac{\sigma_{M}^2}{\sigma_M^2} \\ &= 1 \\ \end{aligned}###Using the statistical function names instead:

###\begin{aligned} \beta_i &= \dfrac{cov(r_i,r_M)}{std(r_i).std(r_M)} \\ \beta_M &= \dfrac{cov(r_M,r_M)}{std(r_M).std(r_M)} \\ &= \dfrac{var(r_M)}{var(r_M)} \\ &= 1 \\ \end{aligned}###Question 408 leverage, portfolio beta, portfolio risk, real estate, CAPM

You just bought a house worth $1,000,000. You financed it with an $800,000 mortgage loan and a deposit of $200,000.

You estimate that:

- The house has a beta of 1;

- The mortgage loan has a beta of 0.2.

What is the beta of the equity (the $200,000 deposit) that you have in your house?

Also, if the risk free rate is 5% pa and the market portfolio's return is 10% pa, what is the expected return on equity in your house? Ignore taxes, assume that all cash flows (interest payments and rent) were paid and received at the end of the year, and all rates are effective annual rates.

The house asset (V) is financed by the home loan debt (D) and the owners wealth or equity in the house (E).

###V = D + E###Owning all of the debt and equity is equivalent to owning the house asset. Therefore the house asset can be seen as a portfolio of debt and equity.

Method 1: Use the CAPM Portfolio beta equation to solve for the beta of equity

Applying the portfolio beta equation, the beta of the asset must equal the weighted average of the betas on debt and equity.

###\beta_\text{portfolio} = \beta_1.x_1 + \beta_2.x_2 + ... + \beta_n.x_n ### ###\begin{aligned} \beta_V &= \beta_D.x_D + \beta_E.x_E \\ &= \beta_D.\frac{D}{V} + \beta_E.\frac{E}{V} \\ 1 &= 0.2 \times \frac{800,000}{1,000,000} + \beta_E.\frac{200,000}{1,000,000} \\ \end{aligned} ### ### \beta_E = 4.2 ###Applying the CAPM,

###\begin{aligned} r_E &= r_f + \beta_E.(r_m - r_f) \\ &= 0.05 + 4.2 \times (0.1 - 0.05) \\ &= 0.26 \\ \end{aligned} ###It may seem surprising that the equity's beta and required total return is so high. The reason is because of leverage. The debt-to-assets ratio (D/V) is 80% and the debt-to-equity ratio (D/E) is 400%. If the value of the house asset rose by 1%, the value of equity would rise by 5%.

Method 2: Use the WACC equation to solve for the cost of equity

Find the required return on debt ##(r_D)## and assets ##(r_V)## using the CAPM:

###\begin{aligned} r_D &= r_f + \beta_D.(r_m - r_f) \\ &= 0.05 + 0.2 \times (0.1 - 0.05) \\ &= 0.06 \\ \end{aligned} ### ###\begin{aligned} r_V &= r_f + \beta_V.(r_m - r_f) \\ &= 0.05 + 1 \times (0.1 - 0.05) \\ &= 0.1 \\ \end{aligned} ###Using the weighted average cost of capital (WACC) equation (before tax since the question says ignore taxes), the cost of equity (also known as the required return on equity or opportunity cost of equity) can be found. ###\begin{aligned} r_V &= \text{WACC}_\text{before tax} \\ &= r_D.\dfrac{D}{V} + r_E.\dfrac{E}{V} \\ 0.1 &= 0.06 \times \dfrac{800,000}{1,000,000} + r_E \times \dfrac{200,000}{1,000,000} \\ \end{aligned} ### ###\begin{aligned} r_E &= \left(0.1 - 0.06 \times \dfrac{800,000}{1,000,000} \right) \times \dfrac{1,000,000}{200,000} \\ &= 0.26 \\ \end{aligned} ###

We can use the CAPM to find the beta of equity from this required return on equity:

###r_E = r_f + \beta_E.(r_m - r_f) ### ###0.26 = 0.05 + \beta_E.(0.1 - 0.05) ### ###\begin{aligned} \beta_E &= \dfrac{0.26 - 0.05}{0.1 - 0.05} \\ &= 4.2 \\ \end{aligned} ###Question 778 CML, systematic and idiosyncratic risk, portfolio risk, CAPM

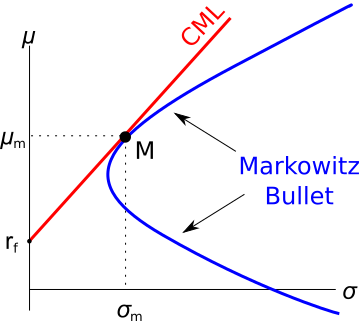

The capital market line (CML) is shown in the graph below. The total standard deviation is denoted by σ and the expected return is μ. Assume that markets are efficient so all assets are fairly priced.

Which of the below statements is NOT correct?

There's only one way a portfolio can plot on the CML (red line): it must be composed of the risk free rate (rf) and the market portfolio (M, which itself is composed of all the risky assets within the Markowitz bullet).

Since the risk free asset has no risk at all (in theory), and the market portfolio has only systematic risk since it's fully diversified, any portfolio combination of these two assets rf and M will therefore have no idiosyncratic risk (also called diversifiable risk). Therefore all assets plotting on the CML have no diversifiable risk, they only have systematic risk.

Question 809 Markowitz portfolio theory, CAPM, Jensens alpha, CML, systematic and idiosyncratic risk

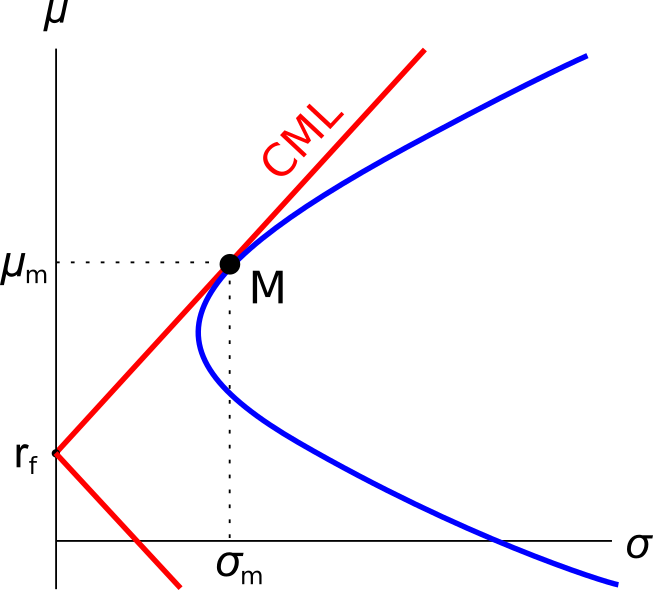

A graph of assets’ expected returns ##(\mu)## versus standard deviations ##(\sigma)## is given in the graph below. The CML is the capital market line.

Which of the following statements about this graph, Markowitz portfolio theory and the Capital Asset Pricing Model (CAPM) theory is NOT correct?

Individual assets and portfolios with returns less than the risk free rate can still be fairly priced so long as they have betas less than zero, consistent with the CAPM. Note that stocks with negative betas will rise when the market falls, so they act like insurance contracts. Holding negative betas assets means you expect to earn less than the risk free rate in the future, which is bad, but when there's a crisis and the market crashes, your assets will be worth more, which is good.

However, individual assets and portfolios with returns less than the risk free rate and positive betas are over-priced, have a negative Jensen’s alpha and should be sold.

Question 810 CAPM, systematic and idiosyncratic risk, market efficiency

Examine the graphs below. Assume that asset A is a single stock. Which of the following statements is NOT correct? Asset A:

Stock A's diversifiable standard deviation is 38.7298335%, not 20%. It can be found using the total variance formula:

###\text{TotalVariance} = \text{SystematicVariance} + \text{DiversifiableVariance}### ###\begin{aligned} \sigma_\text{total A}^2 &= \sigma_\text{systematic A}^2 + \sigma_{\text{diversifiable A}}^2 \\ &= \beta_A^2\sigma_\text{m}^2 + \sigma_{\epsilon\text{ A}}^2 \\ \end{aligned}\\### ###0.4^2 = 0.5^2 \times 0.2^2 + \sigma_{\epsilon\text{ A}}^2 ### ###\begin{aligned} \sigma_{\epsilon\text{ A}}^2 &= 0.4^2 - 0.5^2 \times 0.2^2 \\ &= 0.16 - 0.01 \\ &= 0.15 \\ \end{aligned}\\###Convert the variance to a standard deviation by taking the square root:

###\begin{aligned} \sigma_{\epsilon\text{ A}} &= \sigma_{\text{diversifiable A}} = \sqrt{\sigma_{\epsilon\text{ A}}^2} \\ &= \sqrt{0.15} \\ &= 0.387298335 = 38.7298335\text{% pa} \\ \end{aligned}\\###Question 244 CAPM, SML, NPV, risk

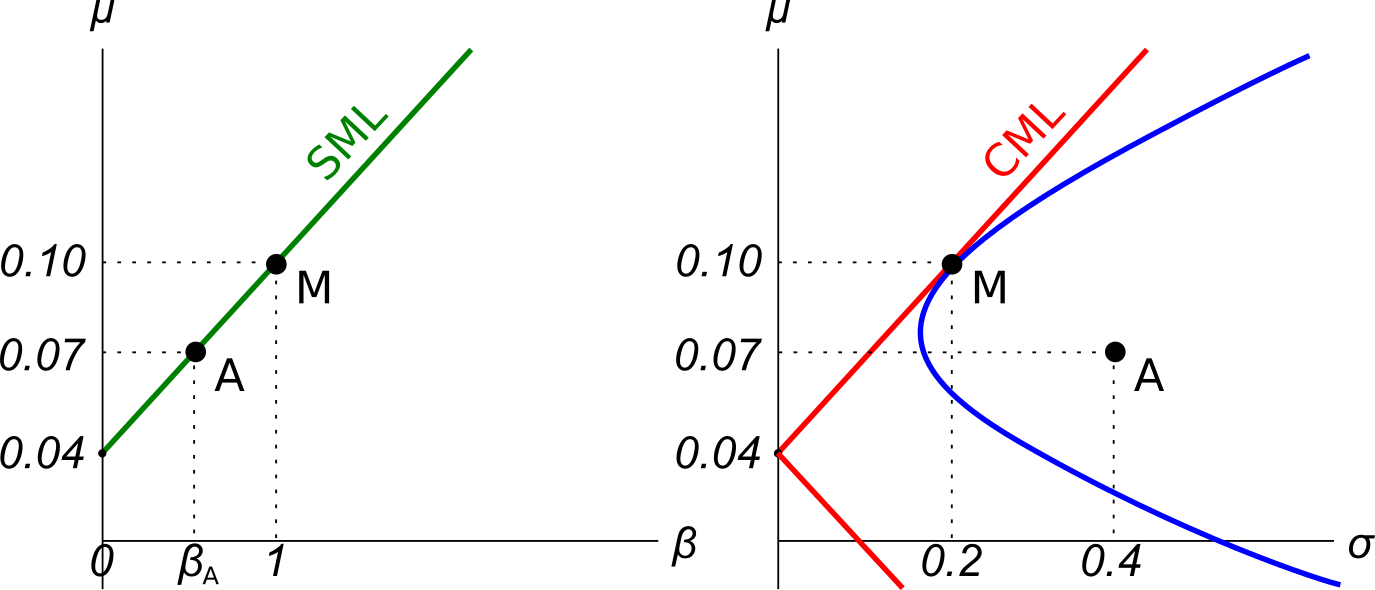

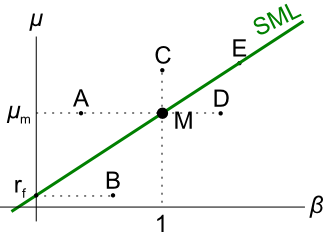

Examine the following graph which shows stocks' betas ##(\beta)## and expected returns ##(\mu)##:

Assume that the CAPM holds and that future expectations of stocks' returns and betas are correctly measured. Which statement is NOT correct?

This question is related to the security market line (SML) in the capital asset pricing model (CAPM). Stocks that plot:

- Above the SML have a positive alpha (or positive abnormal return), are under-priced, and buying them is a positive NPV investment.

Assets A and C are in this category. - On the SML have a zero alpha (or zero abnormal return), are fairly-priced, and buying them is a zero NPV investment.

Assets E, M and ##r_f## are in this category. - Below the SML have a negative alpha (or negative abnormal return), are over-priced, and buying them is a negative NPV investment.

Assets B and D are in this category.

Therefore, answer choices (a), (b), (c) and (e) are all correct.

But answer (d) is not correct since stock D has a higher beta (##\beta##) than the market portfolio (M) since it plots further to the right. Because beta is a measure of systematic risk, stock D must have more systematic risk than the market portfolio, not less.

Question 235 SML, NPV, CAPM, risk

The security market line (SML) shows the relationship between beta and expected return.

Investment projects that plot on the SML would have:

Investment assets that plot on the SML are:

- Expected to neither over- or under-perform, having a zero abnormal return or 'alpha';

- Fairly priced, since the price is fair for the buyer and the seller;

- Zero NPV decisions when bought or sold.

Note that the SML relates beta (a measure of systematic risk) to expected return, so it only accounts for systematic risk and can not be used to gauge diversifiable risk or total risk.

The security market line (SML) shows the relationship between beta and expected return.

Buying investment projects that plot above the SML would lead to:

Investment assets that plot above the SML are:

- Expected to over-perform, having a positive abnormal return or 'alpha';

- Under-priced, the price is cheap;

- Positive NPV decisions when bought by buyers, and negative NPV decisions when sold by sellers.

Note that the SML relates beta (a measure of systematic risk) to expected return, so it only accounts for systematic risk and can not be used to gauge diversifiable risk or total risk.

Stock A has a beta of 0.5 and stock B has a beta of 1. Which statement is NOT correct?

All statements are true except the last phrase in answer (c). The market has a beta of one by definition, and so does stock B. Therefore they have the same level of systematic risk.

But total risk is comprised of systematic and diversifiable risk. Let a stock be represented by 'i'. When risk is measured using variance, then the following equation breaks any stock i's total variance into its systematic and idiosyncratic variances:

###\begin{aligned} \sigma_\text{i, total}^2 &= \beta_i^2.\sigma_m^2 + \sigma_\text{i, diversifiable}^2 \\ &= \sigma_\text{i, systematic}^2 + \sigma_\text{i, diversifiable}^2 \\ \end{aligned} ###

The market portfolio has no diversifiable variance since it is fully diversified. Stock B, on the other hand, is likely to have significant diversifiable variance since it is a single stock. Therefore stock B is likely to have higher total variance than the market portfolio since it has more diversifiable variance.

Which statement is the most correct?

According to the CAPM:

- beta is measured as:

###\begin{aligned} \beta_{i} &= \frac{\sigma_{i,m}}{\sigma_m^2} = \frac{cov(r_i, r_m)}{var(r_m)} \\ \end{aligned} ###

- total variance is the sum of systematic and idiosyncratic variances:

###\begin{aligned} \sigma_\text{i,total}^2 &= \beta_i^2.\sigma_m^2 + \sigma_\text{i,diversifiable}^2 \\ &= \sigma_\text{i,systematic}^2 + \sigma_\text{i,diversifiable}^2 \\ \end{aligned} ###

The risk free rate ##r_f## does not vary, it is a constant, therefore it has zero systematic and idiosyncratic variance and its beta is zero:

###\begin{aligned} \beta_{f} &= \frac{\sigma_{f,m}}{\sigma_m^2} = \frac{0}{\sigma_m^2} = 0 \\ \end{aligned} ###

The market portfolio is a portfolio of risky assets so it has a variance, but by definition its beta is one since the covariance of an asset with itself is equal to its variance:

###\begin{aligned} \beta_{m} &= \frac{\sigma_{m,m}}{\sigma_m^2} = \frac{\sigma_m^2}{\sigma_m^2} = 1 \\ \end{aligned} ###

The market portfolio has no idiosyncratic variance because it is fully diversified, and this makes sense since, using the total variance equation:

###\begin{aligned} \sigma_\text{i,total}^2 &= \beta_i^2.\sigma_\text{m,total}^2 + \sigma_\text{i,diversifiable}^2 \\ \sigma_\text{m,total}^2 &= \beta_m^2.\sigma_\text{m,total}^2 + \sigma_\text{m, diversifiable}^2 \\ &= 1^2.\sigma_\text{m,total}^2 + \sigma_\text{m,diversifiable}^2 \\ &= \sigma_\text{m,total}^2 + \sigma_\text{m,diversifiable}^2 \\ \sigma_\text{m,diversifiable}^2 &= \sigma_\text{m,total}^2 - \sigma_\text{m,total}^2 \\ &= 0 \\ \end{aligned} ###

Therefore the risk free rate has no risk at all so it has zero systematic and diversifiable (or idiosyncratic) risk, and the market portfolio has zero idiosyncratic risk.

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Which of the below statements is NOT correct?

The net present value (NPV) of buying asset A would be positive since it plots above the security market line (SML), it has a positive Jensen's alpha, because it is under-priced.

The net present value (NPV) of buying asset B would be zero since it plots on the security market line (SML), it has a zero Jensen's alpha, because it is fairly priced.

Assets A, B, M and ##r_f## are shown on the graphs above. Asset M is the market portfolio and ##r_f## is the risk free yield on government bonds. Assume that investors can borrow and lend at the risk free rate. Which of the below statements is NOT correct?

If risk-averse investors were forced to invest all of their wealth in a single risky asset A or B (not M since it's a portfolio) then they cannot diversify so total risk is important to them, not just systematic risk. Total risk is shown on the left graph's x-axis. Total variance equals systematic variance plus diversifiable variance:

###\text{TotalVariance} = \text{SystematicVariance} + \text{IdiosyncraticVariance}### ###\begin{aligned} \sigma_\text{total i}^2 &= \sigma_\text{systematic i}^2 + \sigma_{\text{idiosyncratic i}}^2 \\ &= \beta_i^2\sigma_\text{m}^2 + \sigma_{\epsilon\text{ i}}^2 \\ \end{aligned}\\###People who prefer low risk will choose asset B instead of A since ##\sigma_\text{B total} = 0.1## is less than ##\sigma_\text{B total}= 0.4##.

They're the sort of people who might carry an umbrella in their bag even when it's sunny, just in case it might rain. They suffer carrying it around but occasionally it helps them avoid getting drenched and sick. Or perhaps they purchase comprehensive car insurance. They're afraid of risk and are prepared to suffer low expected (average) returns to avoid large losses.

People who prefer high returns will choose asset A instead of B since ##\mu_A = 0.12## is greater than ##\mu_B = 0.075##.

They're the sort of people who may not purchase comprehensive car insurance because they're comfortable with the possibility of crashing their car and losing a large sum to replace it, if it means that they will have more money otherwise. They're comfortable with the possibility of suffering large losses if it means that on average they could gain more.

Choosing asset A or B is a personal choice, there's no correct answer. It depends on your return versus risk preferences. Of course in reality, you're not restricted to choose between A or B, you can choose a bit of both by making a portfolio which is the best idea.